As a venture capital firm, focusing at the early stages of growth, Accel is constantly faced with the internal challenges of identifying the best up-and-coming companies for investment opportunities. It is essential that Accel can effectively allocate their partners’ time and energy towards connections that have a high likelihood of leading to a successful investment deal.

Challenge

The fast-paced and highly competitive world of venture capitalism has a lot to gain from digital tools that can quickly and efficiently sift through mountains of information to generate meaningful insights and help their teams make the right business decision. In order to build this digital solution, Accel engaged with Sidebench to develop an in-depth strategic proposal followed by the design of a light version of the proposed solution to test and trial adoption within the company culture.

Strategic Proposal

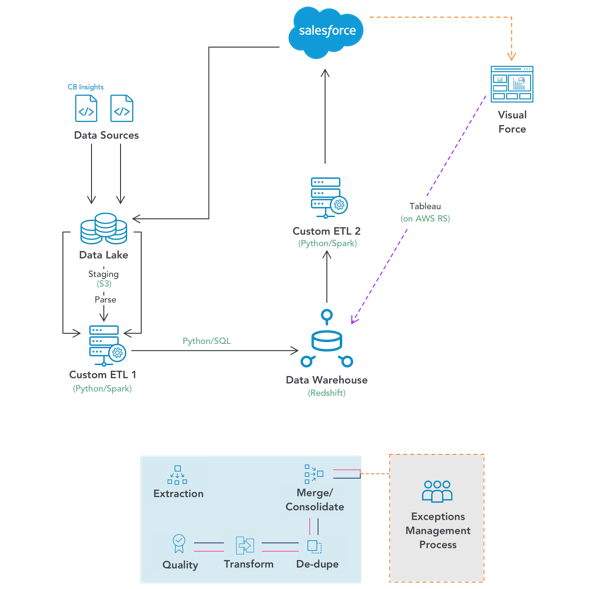

Beginning with a problem statement, we mapped our thoughts, taking 4 or 5 major pivots before arriving at a potential solution that could effectively solve the challenges Accel was facing. The idea was to scrape public and non-public data sources containing information relevant to potential investment opportunities (think technology blogs, Github, CB Insights, Crunchbase, recent incorporations in Delaware, etc.), sifting through this firehose of data to identify fledgling companies and founders before competing venture capitalists.

Solution

The solutions process would include a data lake, a data warehouse, and Accel’s internal CRM Salesforce, to link relevant people and companies across a number of different data sources, and generate a unified view of a particular company or the people involved with the company. This investment opportunity data would present as part of a structured custom dashboard within Salesforce.

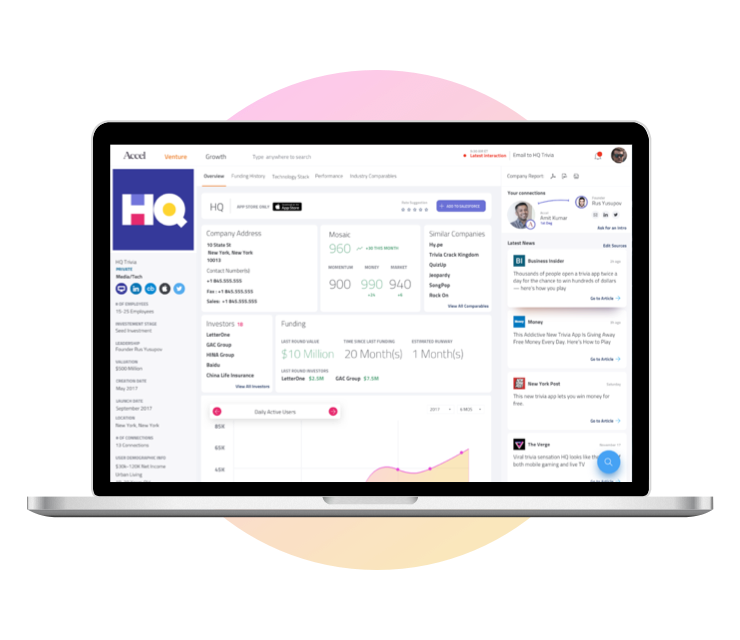

The solutions process would include a data lake, a data warehouse, and Accel’s internal CRM Salesforce, to link relevant people and companies across a number of different data sources, and generate a unified view of a particular company or the people involved with the company. This investment opportunity data would present as part of a structured custom dashboard within Salesforce.  The Salesforce dashboard would categorize data, ranking the content to make it easy to see who the closest connection to a specified target investment company might be using Linkedin or other social networking sites.

The Salesforce dashboard would categorize data, ranking the content to make it easy to see who the closest connection to a specified target investment company might be using Linkedin or other social networking sites. Initially, the most valuable opportunities would be identified by Accel analysts through up-votes and downvotes which would in turn train an artificial neural network to help automate this process in the future.

Initially, the most valuable opportunities would be identified by Accel analysts through up-votes and downvotes which would in turn train an artificial neural network to help automate this process in the future.

Light Version of the Solution

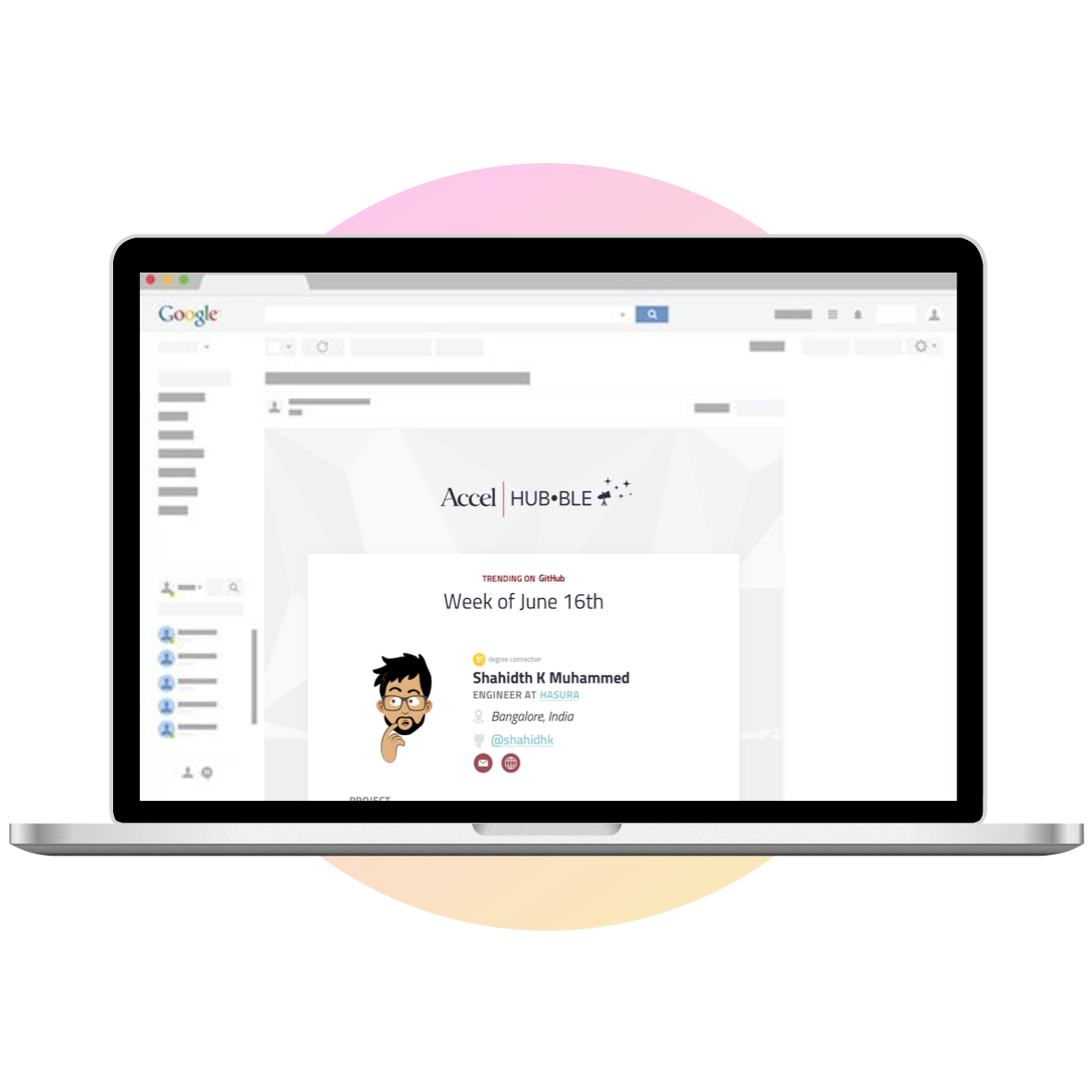

In order to demonstrate the value of the solution to the relevant internal stakeholders, we designed a program that uses GitHub APIs to identify popular projects with community momentum behind them. Using a relationship graph, the platform highlights the Accel team’s 1st and 2nd-degree connections to the corresponding projects. These insights are consolidated into an easily digestible email newsletter sent out to the team on a weekly basis.